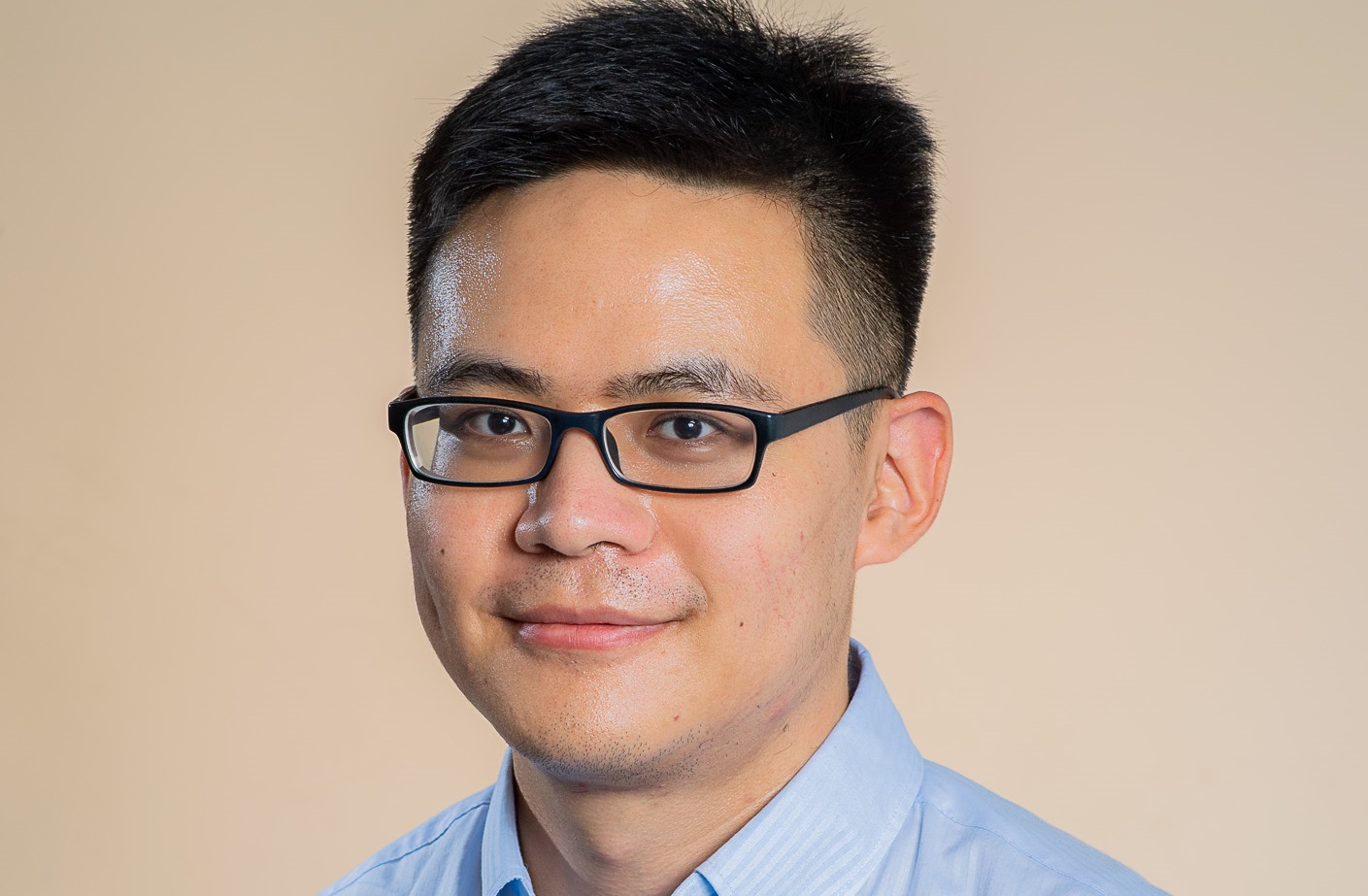

PHD DISSERTATION DEFENSE, JUNLI ZHAO, FINANCE

Congratulations to Dr Junli Zhao, Finance specialization, who successfully defended his Doctoral Dissertation at HEC Paris, on August 12, 2021. Dr Zhao will join City University of London, Bayes Business School on September 1, 2021.

Specialization: Finance

Dissertation Topic: Essays on intermediation in financial markets

Advisor: Jean-Edouard Colliard, Associate Professor, HEC Paris

Jury Members:

- Joel Peress, Professor, INSEAD

- Liyan Yang, Professor, University of Toronto

- Johan Hombert, Associate Professor, HEC Paris

- Jean-Edouard Colliard Associate Professor, HEC Paris, Advisor

Abstract:

Should financial experts (e.g., buy-side asset managers and analysts) fear the rise of algorithms? As machine-readable (clean and structured) data are essential for the development and functioning of algorithms, I study this question by investigating whether financial experts benefit from more machine-readable data in information production in asset management. I first develop a model in which an institutional investor’s performance and asset holdings depend on two inputs: the amount of machine-readable data and the number of financial experts, and derive how changes induced by an increase in the amount of machine-readable data depend on the relation between the two inputs. Exploiting an exogenous regulatory shock that makes corporate filings more machine-readable, I find that institutions with more financial experts experience larger performance improvement than institutions with fewer financial experts, consistent with financial experts benefiting from more machine-readable data. This result helps evaluate the disruption brought by modern algorithms. Keywords: Information Technology; Skilled Labor; Information Acquisition.

The thesis contains three essays. In the first essay, I investigate whether financial experts benefit from more machine-readable data in information production in asset management. Exploiting an exogenous regulatory shock that makes corporate filings more machine-readable, I find that institutions with more financial experts have larger performance improvement than institutions with fewer financial experts, suggesting financial experts benefiting from more machine-readable data. This result helps evaluate the likelihood of algorithms replacing high-skilled financial practitioners. In the second essay, I study the rationale and implications of the recent MiFID II regulation in Europe that made delegated asset managers’ spending on sell-side analyst research more transparent to their clients. We show that transparency decreases the use of sell-side research but stimulates more buy-side research activities, which is consistent with empirical findings. Our model has additional predictions on managers’ performance, liquidity, and social welfare. In the third essay, I study brokers in private placement markets, who intermediate about 20% of capital raised by non-financial firms in this market. I find that projects intermediated by brokers with better reputations are more likely to be fully funded. Contrary to existing theories on underwriters, projects sold through brokers are less likely to be fully funded on average and most issuers prefer direct selling. A model that features both search frictions and asymmetric information suggests that these non-regularities may be due to the fact that the certification role of brokers is limited by competition between intermediated selling and direct selling. The model also explains some non-intuitive patterns of commission fees in the data. These results contribute to a better understanding of private placement markets and intermediaries in other financial markets.